|

This video from the Culinary Institute will show you how to expertly carve a turkey!

0 Comments

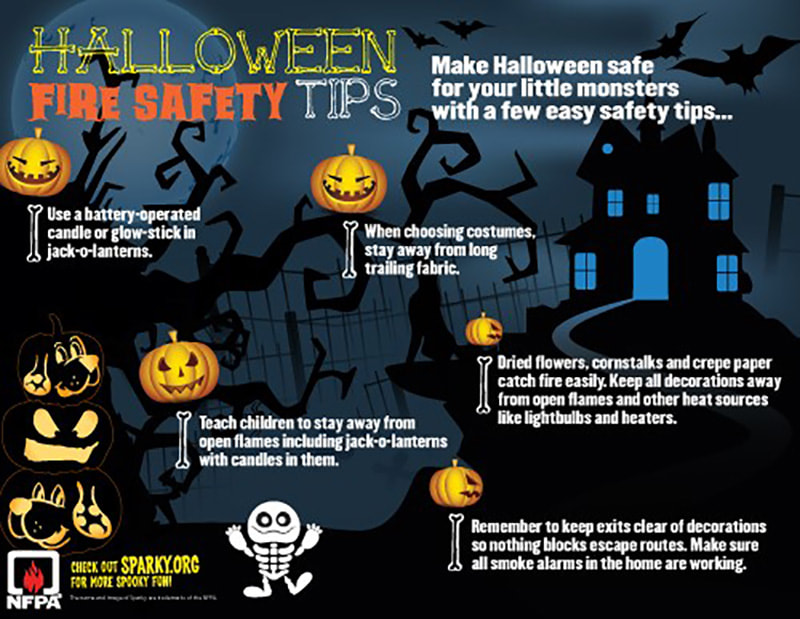

Protect yourself from Halloween horrors with these few simple tips for fire and theft as well as the top children's safety tips! Ghouls, Ghosts and haunted houses are not the only scary things homeowners should be ready for during Halloween season. Fires, theft and vandalism are scary insurance claims that have haunted homeowners in the past. Fortunately, most homeowners’ policies will cover the common losses during Halloween. Here are some tips to help avoid potential spooky insurance claims. Fire Hazards: Halloween is all fun and games until a ghost or goblin knocks over a jack-o-lantern setting your property on fire. Planning can help make this Halloween a fire safe one. According to National Fire Protection Association, nearly a thousand home fires are caused by Halloween decorations. However, don’t get too spooked, a fire started by a Halloween candle will be covered. But, it is safest to use a glow stick or battery operated candle in a jack-o-lantern. Top 6 Halloween Fire Safety Tips:

Theft/Vandalism: While trick-or-treaters are in search of candy, beware of devilish unwelcome thieves and vandals prowling on your property. Avoid luring these creepy crawlers to your dark home by leaving your lights on (even if you leave your home). You might also consider motion detection lights for your yard. Fortunately, theft, burglary, and vandalism are covered under ‘most’ homeowners insurance policies. We always recommend homeowners keep a list of their belongings - be it picture, video or paper lists and what they are worth (if you can) to help making a claim smoother. Watch this quick 1 minute YouTube video on Halloween Safety Tips for Children from the National Fire Protection Association. Call Natwick Insurance if you would like to review your policy to ensure you have ample coverage in place to protect you in the case of a spooky claim! 321-735-0381 Call Us! The Natwick Insurance Team hopes everyone has a Spook-Tacular, Be-Witching, & Fang-Tastic Halloween Season! Natwick Insurance "Providing Insurance Solutions with Personal Service"

Call Us 321-735-0381 Located in Satellite Beach #satellitebeach #natwickinsurance #halloween #halloweensafetytips Sunday is National Grandparents Day!

Grandparents Day always falls on the first Sunday after Labor Day in the U.S. — which means September 8, 2019. Grandparents Day is, in fact, a real holiday when in August 1978, Jimmy Carter signed a proclamation designating the first Sunday of September after Labor Day as 'National Grandparents' Day" What are you going to do to recognize the grandparents in your life?!? You could: *Interview one of your grandparents and keep that memory for life *Cook breakfast, lunch or dinner for your grandparents *Spend the day with your grandparents Happy Grandparents Day Weekend to All of the Amazing Grandparents out there!!! When Did Grandparents Day Become a Holiday 1920's Marian McQuade: The eventual founder of National Grandparents Day accompanies her grandmother as she distributes food and checks to elderly neighbors near the family farm in West Virginia. This fostered a lifelong interest in seniors - and most notably, grandparents. 1956 Special Tribute: McQuade helps to launch a special tribute to West Virginia's octogenarians which starts her on the road to activism on behalf of seniors. 1969 A Letter to the President: In 1969 when Russell Capper was age 9 he sent a letter to President Nixon suggesting a special day be set aside as Grandparents Day. On June 12th 1969 he received a letter back from the personal secretary to the President thanking him for his suggestion but the President ordinarily issues proclamations designating periods for special observance only when a Congressional resolution authorizes him to do so. Since this letter Marian McQuade was recognized nationally by the US Senate and by President Jimmy Carter, as the founder of National Grandparents Day. McQuade made it her life goal to educate the youth in the community about the important contributions seniors have made throughout history. 1973 National Holiday: Senator Jennings Randolph introduced a resolution to the senate to make Grandparents' Day a National Holiday. Marian McQuade organized supporters and began contacting governors, senators and congressmen in all fifty states. Within three years she had received Grandparents' Day proclamations from forty-three states. 1977 Issued Proclamation: Designating the first Sunday of September after Labor Day of each year as 'National Grandparents Day'. 1978 Accomplishing a Dream: Congress passed the legislation on August 3rd, and then-President Jimmy carter signed the proclamation to honor grandparents. Giving grandparents an opportunity to show love for their children's children, and to help children become aware of the strength, information and guidance older people can offer. #grandparentsday #nationalgrandparentsday #grandma #grandpa #grandparentsarethebest Hurricane Season is upon us. The Gulf Coast of FL is already seeing a named storm "Tropical Storm Barry" and now our East Coast is preparing for Tropical Storm Dorian who may turn into Hurricane Dorian by the time it reaches our coast. ARE YOU READY!?!? With the Season in full swing, we thought it was important to help make sure our customers, friends and family have the important information needed to be safe before, during and after a Tropical Storm or Hurricane hits. To receive alerts from the Brevard EOC (Emergency Operations Center) send a text to 888-777 with BREVARDEOC to sign up. PDF Guides For You To Save Are Below:

NEED TO MAKE A CLAIM? CLICK HERE Plan for a Hurricane! The best time to prepare for a hurricane is before hurricane season begins on June 1. But let's be real... I can't even prepare for the week ahead, but this Season is no joke and can sneak up on us fast! It is vital to understand your home's vulnerability to storm surge, flooding, and wind. Here is your checklist of things to do BEFORE hurricane seasons begins or at least before one is named and heading towards us.

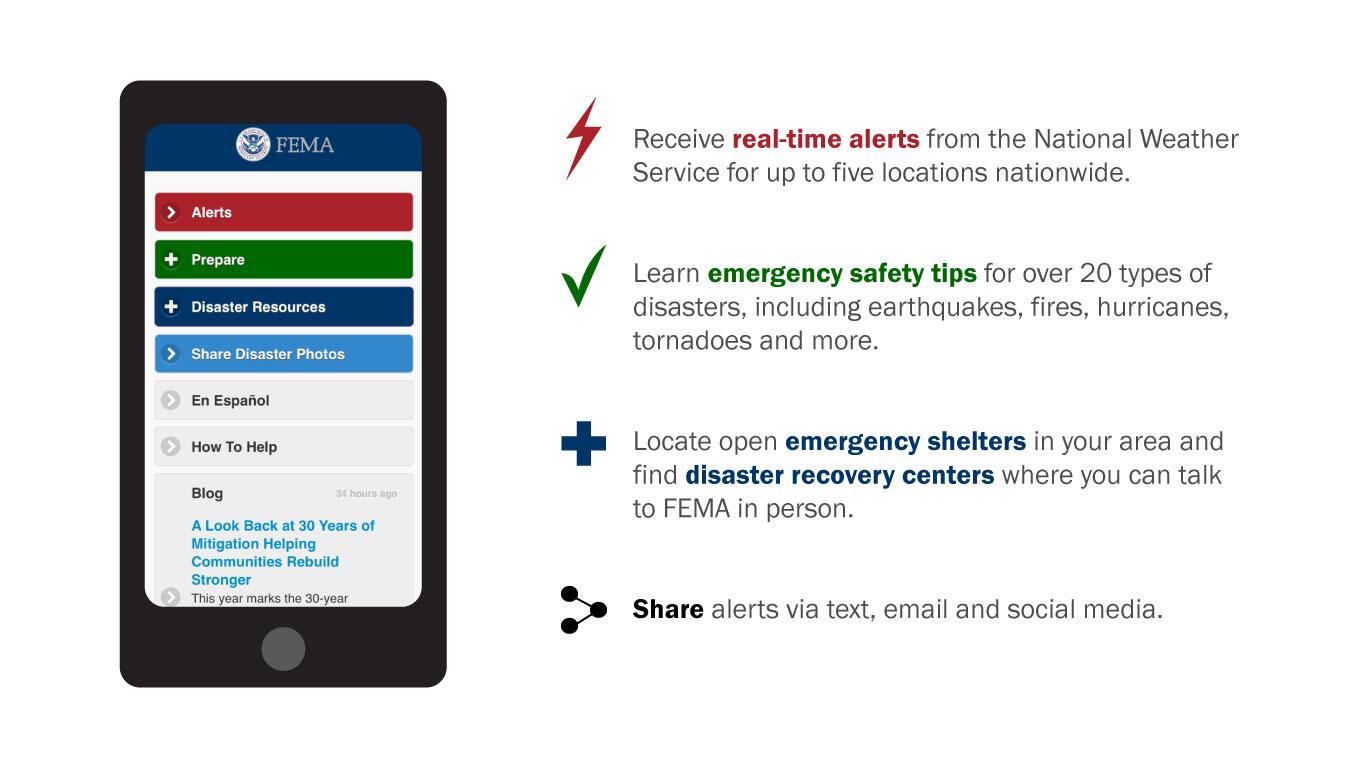

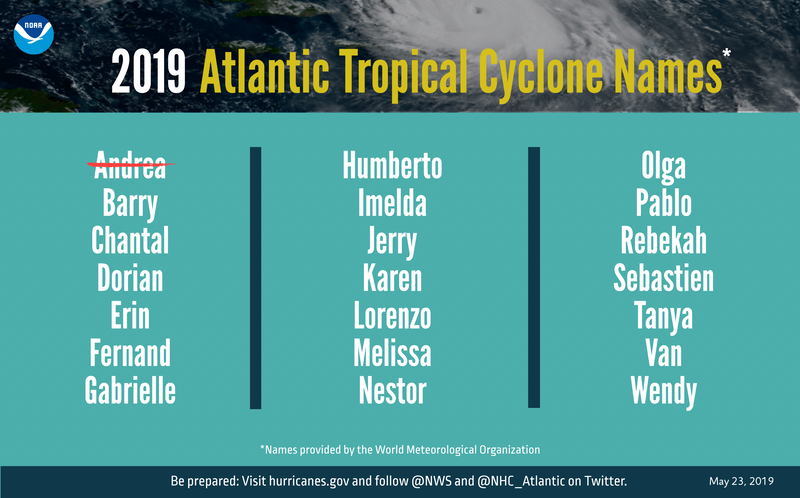

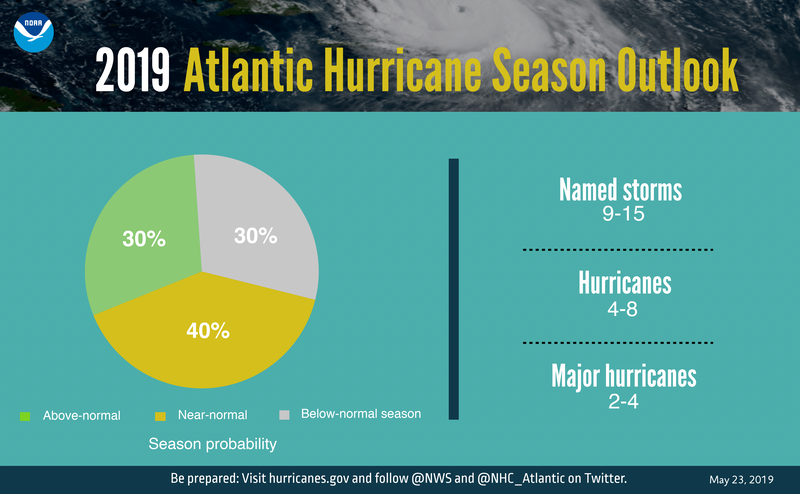

Did you know...? FEMA has an app now?! Where you can receive real time alerts, emergency safety tips, emergency shelters and more. It took me less than 3 minutes to download the app and add my locations under the "Alerts" section. (You can have up to 5 locations.) It is very user friendly. You can choose to see Flooding, severe weather alerts, tropical weather, tsunamis, extreme temperatures, visibility & air quality, fire weather, marine/sea/surf and other public hazard alerts. FYI when choosing location... it does ask for City but it covers the entire county that city is in. I am thinking this app will prove to be beneficial in time of an emergency. I recommend downloading it. *FEMA App not affiliated with Natwick Insurance. This is a personal opinion of staff member writing Blog on behalf of Natwick Insurance. In taking the time to research information at www.nhc.noaa.gov (National Hurricane Center) I found some interesting statistics and facts and thought it would be beneficial to whom ever reads this. Here are the 2019 Atlantic Tropical Cyclone Names and the 2019 Atlantic Hurricane Season Outlook numbers. Did You Know...? Whenever a tropical cyclone (a tropical depression, tropical storm, or hurricane) or a subtropical storm has formed in the Atlantic or eastern North Pacific, the NOAA NHC issues a tropical cyclone advisory products at least every 6 hours at 5 am, 11 am, 5 pm and 11 pm. When warnings are in effect, the NHC issues Tropical Cyclone Public advisories every 3 hours. You can find out more at www.hurricanes.gov for the Atlantic updates. So what is the difference between Outlooks, Advisories, Watches & Warnings?!?!? I am glad you asked! Outlook Tropical Weather Outlook: The Tropical Weather Outlook is a discussion of significant areas of disturbed weather and their potential for development during the next 5 days. The Outlook includes a categorical forecast of the probability of tropical cyclone formation during the first 48 hours and during the entire 5-day forecast period. You can also find graphical versions of the 2-day and 5-day Outlook at www.hurricanes.gov Advisories

Watches Listen closely to instructions from local officials on TV, radio, cell phones or other computers for instructions from local officials. Evacuate if told to do so.

Warnings Listen closely to instructions from local officials on TV, radio, cell phones or other computers for instructions from local officials.Evacuate immediately if told to do so.

Hurricane, tropical storm, and storm surge watches and warnings can also be issued for storms that have lost some or all of their tropical cyclone characteristics, but continue to produce dangerous conditions. These storms are called “post-tropical cyclones” by the NWS. We hope you found this information on everything Tropical Storm and Hurricane Related! If you need any assistance with your personal or commercial insurance, don't hesitate to connect with the Natwick Insurance Team! NatwickInsurance.com / [email protected] / 321-735-0381 / Conveniently located in Satellite Beach, FL. Providing Insurance Solutions with Personal Service Since 2006

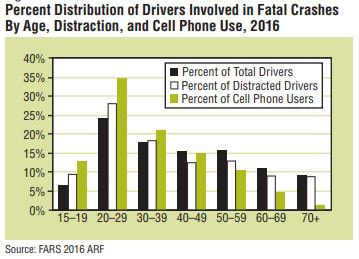

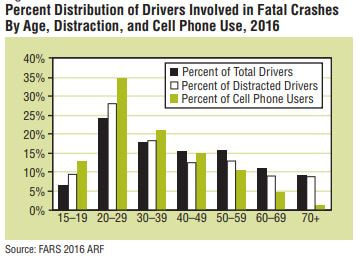

It is time your insurance makes your New Year’s Resolution list! We know not everyone sticks to their new year’s resolutions… you can tell by the dusty exercise equipment or projects left un-done. There are a few resolutions that stick, and we think you should add reviewing your insurance towards the top of your list this year. The Natwick Insurance Team thinks it is a good idea to start each new year by reviewing your insurance coverage because home, auto, boat and other insurance needs change over time. A growing family, new jobs, moving or buying/selling autos are just a few examples of changes that can affect your insurance coverage and premiums. Too often, policy holders purchase insurance and assume they will never need to make a claim and file the policy away, they rarely take the time to review it to confirm everything is still protected. Insurance is there in case of an emergency, it is always wise to make sure it covers what you will really need. When it comes time to use your insurance you’ve paid all year for, the last thing you want to learn is that you don’t have enough coverage or the right coverage. We also think it is important to review your policies to ensure you aren’t paying for coverage you don’t need. The start of the new year is a good time to update inventory of your possessions. You will need to provide the insurance adjuster an accurate list if you have to make a homeowner’s insurance claim. More than likely you acquired some new things over the year or you might have been given a valuable gift like a new TV or jewelry. Having a list of your contents that should be accounted for in your home in case of a loss will allow you to get them back (or the value of them back) without tapping your bank account. If you are like me and don’t like making lists and checking it twice… you can make a video recording of your home and your personal possessions inside. If there is a theft or fire, you will have proof that you own the items you are claiming. This is where details really do matter… some policies cover for replacement cost while others will pay only the actual cash value, meaning you’re reimbursed for the depreciated value of an item (think garage sale prices). Do you know what your policy actually covers? Let the Natwick Insurance Team review your policy with you to ensure you know exactly what you are covered for. With housing prices increasing, other than your personal contents in your home, you will also want to review your policy to ensure your home insurance coverage's remains high enough if you ever must rebuild or repair at today’s construction prices and building codes. Natwick Insurance also recommends reviewing your auto insurance policies. The amount you drive, and which vehicles are being used to drive will make a difference on your premium. If you have changed employment or residence and your daily commute isn’t as far as it used to be you could find savings by re-quoting your policy. One of the things that will have the largest effect on your auto insurance premium is your driving history. Making a resolution to driver safer and avoid distractions like texting while driving will help ensure your auto insurance doesn’t go up! If you had a year without any accidents and/or tickets, then let’s review your insurance to see if your good driving history can save you money by re-quoting your policy. Knowing what your auto insurance actually covers is just as important as knowing your homeowner’s insurance coverage… Comprehensive coverage, towing and car rental insurance will be important if your car is damaged in an accident. How about UM (Uninsured or Under-insured Motorists) coverage, do you have it? 23% of Florida drivers are not insured, what happens to you if you’re involved in an accident caused by that un/under insured driver? Does your auto insurance have you covered? If you are not sure about your insurance coverage's and/or if you just want to review your insurance policies contact the Natwick Insurance Team at 321-735-0381 or [email protected] to help you fully understand all of your insurance policies and what they cover. Natwick Insurance is your full-service independent insurance agency who has been Providing Insurance Solutions with Personal Service since 2006.  Natwick Insurance is growing! In just over a year the Natwick Team has grown from 2 agents to 5 to meet their growing needs and continue providing their customers with excellent customer service. In their agency, they take great pride in the quality of service they provide to their customers. Whether their clients need help filing a claim, processing a payment, or just understanding their insurance coverage the Natwick Insurance Team will always be there ready to help. At Natwick Insurance, they know their clients and they know insurance, so you have the peace of mind that comes with knowing your insurance agency can help you regardless of how big, small, unique, or specific your insurance needs are. Meet the Natwick Insurance, Inc. Team they are your local independent insurance agency providing “Insurance Solutions with Personal Service”. Erik & KT Natwick... Erik is our agency founder. After having worked years in the industry under those who focus so much on numbers and not on the people – he wanted to bring a personal touch to his customers, so he founded his own agency to truly provide insurance solutions with personal service, which is where our “motto” came from. He has more than 15 years’ experience in the insurance industry, a Bachelor of Science in Business Administration from The University of Florida; “Go Gators”. You may have seen Erik around, he was raised in Satellite Beach, coaches Satellite Beach P.A.L. basketball, volunteers with his Church Trinity Wellsprings, and lives in town with his beautiful wife KT who also works with the Natwick Ins. Team and their two fun-loving kids Logan & Reid. Kyle Morrell... Kyle is a licensed insurance specialist who has 10+ years’ experience in the insurance industry. Problem solving to create solutions tailored for each unique customer is what drives him. He’s a military “brat” who came here in 1990 – lived in South Patrick Housing, attended Delaura, Satellite High School, Brevard Community College before it became EFSC and The University of Florida. Kyle is a father of 5 and has been married to his beautiful wife Christine for 14 years. Kyle coaches his children’s sports and can be found exercising most every day of the week. The amazing Florida weather permits him to stay active outdoors all year long doing numerous things from swimming, to biking, to running or just taking a walk with his family and new Golden Retriever puppy, Sunny. Donnie & Karrie Torok… Donnie was enjoying working with the Natwick Insurance team so much over the past 3 years that Karrie recently “jumped ship” from the world of management and operations to focus their collective career on helping members of the community navigate the world of personal and commercial insurance. You've probably seen Donnie around, he is the current President of the BNI, Beeliners group in Merritt Island and volunteers with local non-profits like Anglers for Conservation and Candlelighters of Brevard. Karrie was born in Melbourne, back when Holmes Regional was called Brevard Hospital and in 2004 she brought Donnie to sunny Florida from Ohio. Donnie, Karrie & their dog Rico Suave spend as much time as possible paddle boarding the canals, exploring nature and having adventures with their nieces. Thanks for taking the time to learn more about our agency and please feel free to contact us any time about anything. Let our Team help you with all of your insurance needs! Our Services: *Home *Condo *Flood *Auto *Boat *Motorcycle *RV *Workers' Compensation *General Liability *Commercial Property * Builders Risk Natwick Insurance, Inc. 321-735-0381 [email protected] NatwickInsurance.com  Veterans Day is observed annually on November 11 that honors persons who served in the United States Armed Forces. This date marks the anniversary of the end of World War I originally known as Armistice Day and Remembrance Day. Major hostilities of World War I were formally ended at the 11th hour of the 11th day of the 11th month in 1918. The U.S. Holiday was renamed Veterans Day in 1954. This is the 100th Anniversary of our enemies laying down their arms in accordance with the armistice with Germany which rendered them impotent to renew hostilities, and gave the world an assured opportunity to reconstruct its shattered order and to work out in peace a new and juster set of international relations. As stated by President Woodrow Wilson on November 11, 1919 "To us in America the reflections of Armistice Day will be filled with solemn pride in the heroism of those who served in the country's service, and with gratitude for the victory, both because of the thing from which it has freed us and because of the opportunity it has given America to show her sympathy with peace and justice in the councils of nations." At Natwick Insurance we honor all who served this and every day. Thank you for your service! Natwick Insurance, Inc *Providing Insurance Solutions with Personal Service since 2006* 321-735-0381 / [email protected] / www.NatwickInsurance.com 1301 S. Patrick Dr. #73, Satellite Beach, FL 32937 Link to Wikipedia page where details were found: https://en.wikipedia.org/wiki/Veterans_Day  Distracted Driving is defined as any activity that diverts attention from driving, including talking or texting on your phone, eating and drinking, talking to people in your vehicle, fiddling with the stereo, entertainment or navigation system - anything that takes your attention away from the task of safe driving. By now we have all heard & seen texting is the most alarming distraction. Sending or reading a text takes your eyes off the road for 5 seconds. At 55 mph, that's like driving the length of an entire football field with your eyes closed. According to NHTSA (National Highway Traffic Safety Administration), you cannot drive safely unless the task of driving has your full attention. Any non-driving activity you engage in is a potential distraction and increases your risk of crashing. I have to say, I agree with their statements. I started doing some research to find out statistics on distracted driving... Wondering, is texting the highest reported distraction or is talking on the phone just as dangerous? Once I started doing more research I was shocked at the findings, so much so, that I wanted to share this with our community and hope it reaches all drivers and future drivers of Florida and the United States as a whole. Did you know, during daylight hours, approximately 481,000 drivers are using cell phones while driving. That creates huge potential for deaths and injuries on U.S. roads. Teens were the largest age group reported as distracted at the time of fatal crashes. Here are some stats courtesy of NHTSA: These stats are from a 2016 study - distracted driving has increased in the past two years. Let these numbers really sink in and then ask yourself, is that text or call really worth potentially losing everything including your or someone else's life?

Here is a Link to the NHTSA/NOPUS Driver Electronic Device Use in 2016 Research Note Here is a Link to the NHTSA/NOPUS Distracted Driving 2016 Statistical Findings Summary Fatalities in Distraction-Affected Crashes: In 2016, there was a total of 34,439 fatal crashes in the United States involving 51,914 drivers. As a result of those fatal crashes, 37,461 people were killed. Much attention across the country has been focused on the dangers of using cell phones and other electronic devices while driving. In 2016, there were 444 fatal crashes reported to have involved cell phone use as a distraction (14% of all fatal distraction-affected crashes). For these distraction-affected crashes, the police crash report stated that the driver was talking on, listening to, or engaged in some other cell phone activity at the time of the crash. A total of 486 people died in fatal crashes that involved cell-phone-related activities as distractions. To prevent tragedies due to distracted driving, motorists are urged to:

All pedestrians and bicyclists should focus on their surroundings and not on their electronic devices as well to avoid being at a higher risk of being injured due to someone else's negligence. Natwick Insurance, Inc. is here to Provide Insurance Solutions with Personal Service. Let us help you navigate your auto insurance as well as any of your other insurance needs. Natwick Insurance serving Brevard County since 2006. 321-735-0381 www.NatwickInsurance.com Click here to view 2016 Fatal Motor Vehicle Crashes: Overview Click here to view 2016 Quick Facts Resources: National Highway Traffic Safety Administration & US DOT

Research and Information Sites:

www.myfloridacfo.com www.sba.gov Did you know at Natwick Insurance, Inc. we offer Pet Insurance? Your pets are family too! We know how important your little fur babies can be to you and your family. That's why we are delighted to offer you pet insurance for your dog and/or cat! Pet Insurance helps ensure you can give your dogs and cats the quality care they need, from routine checkups to emergency services. We work with carriers who offer well-designed coverages to protect your pet. The best part is, getting pet insurance is easy! There are only 5 rating variables needed: Zip code, dog or cat, breed, age and gender. Great Choices, Great Coverage! Coverage available for: -Accidents/injury -Illness -Hospitalization -Emergency vet visits -Surgery -Vaccinations -Annual physicals -Flea prevention -Dental trauma -Some alternative therapies -Microchip implantation -And much more Pet insurance will reimburse you the actual costs for covered expenses that you incur during the policy period, after subtracting your deductible and applying the reimbursement percentage, listed on the declarations page. Reimbursement of covered expenses is subject to the annual limit listed on your declarations page and any other applicable coverage limitations and exclusions. Get started today and let us help you manage the rising cost of veterinary care! Natwick Insurance 321-735-0381 Disclaimer: 1 *Pre-existing conditions are not covered. Waiting periods, annual deductible, co-insurance, benefit limits and exclusions may apply. Preventive Care reimbursements are based on a schedule. Complete Coverage SM reimbursements are based on the invoice. Products and discounts may vary and are subject to change. Plans are underwritten by United States Fire Insurance Company and administered by Fairmont Specialty Insurance Agency (FSIA Insurance Agency in CA), a Crum & Forster company. C&F and Crum & Forster are registered trademarks of United States Fire Insurance Company. The Crum & Forster group of companies is rated A (Excellent) by AM Best Company 2015. Hartville Pet Insurance Group℠ is a trademark of United States Fire Insurance Company. The United States Fire Insurance Company and Fairmont Specialty Insurance Agency may be individually or collectively referred to as Hartville Pet Insurance Group℠ or Hartville. C&F and Crum & Foster are registered trademarks or the United States Fire Insurance Company. Crum & Forster Enterprises a part or Fairfax Financial Holdings Limited. 2 *Discount not available in FL, MN and PA. |

Contact Us

(321) 735-0381 Archives

November 2019

Categories |

Navigation |

Social MediaShare This |

Contact UsNatwick Insurance, Inc.

1301 South Patrick Drive Suite 73 Satellite Beach, FL 32937 (321) 735-0381 Click Here to Email Us |

Location |

Natwick Insurance, Inc. - Established 2006

RSS Feed

RSS Feed