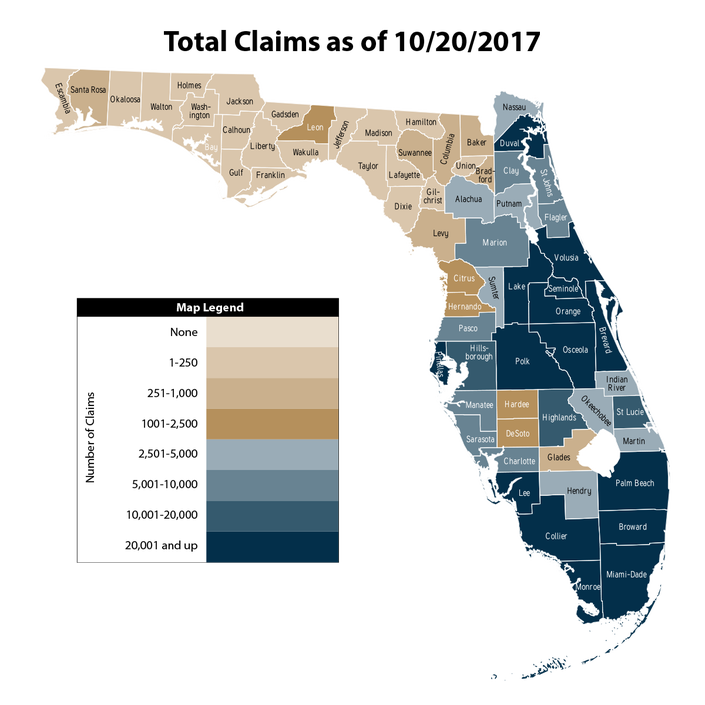

As reported by the Florida Office of Insurance Regulation more than 646,000 residential property claims and over 41,000 commercial property claims were filed as of October 20, 2017. If we include private flood, business interruption and other lines of business claims filed, it is just over 772,900 claims filed and an astounding $5,311,772,141.00 in estimated insured losses! Brevard County had 35,531 of the 772,900 claims in Florida and more than a month after Hurricane Irma reared her ugly winds and rain our way there are 21,847 claims still open. We at Natwick Insurance are grateful to have had our business and homes spared so we could be there to help our clients immediately after Hurricane Irma passed. Living in our beautiful community we sometimes forget why having the right protection in place to reduce our risks during hardships like this is so important. There are a number of residents and business owners who had gaps in their coverage that left them without the protection they needed. You would be surprised at how many home and business owners don’t have the right insurance protection in place. On average 3 out of 5 of the clients we serve had gaps in their coverage before working with us that we were able to find and fix. Not only were we able to identify and correct these risks, often times we did it at about the same price! As you can see by the map nearly all of Florida was affected by this Hurricane Season. We found the data from the latest Florida Office of Insurance Regulation interesting and hope you did too. As an independent insurance agency we look forward to having the opportunity to be your advocate to get you the best coverage at the best price to deliver the best results. Article Data Reference: Florida Office of Insurance Regulation reported 10/20/2017 *This aggregate information is compiled from claims data filed by insurers. It has not been audited or independently verified and covers all claims based on filings received by the Florida Office of Insurance Regulation as of October 20, 2017 at 3:00pm. Leading up to September 20, 2017 the Office reached out to insurers that had asserted trade secret protection on their Hurricane Irma claims data to request they waive that assertion so the Office could publish aggregate county level data to the public. Because the Office obtained enough waivers, they were able to report their efforts allowed the release of aggregate Hurricane Irma claims date on a county basis.

0 Comments

|

Contact Us

(321) 735-0381 Archives

November 2019

Categories |

Navigation |

Social MediaShare This |

Contact UsNatwick Insurance, Inc.

1301 South Patrick Drive Suite 73 Satellite Beach, FL 32937 (321) 735-0381 Click Here to Email Us |

Location |

Natwick Insurance, Inc. - Established 2006

RSS Feed

RSS Feed