|

Nearly one in eight U.S. motorists are driving around uninsured and putting insured drivers at greater risk in the event of an auto accident, according to a study.

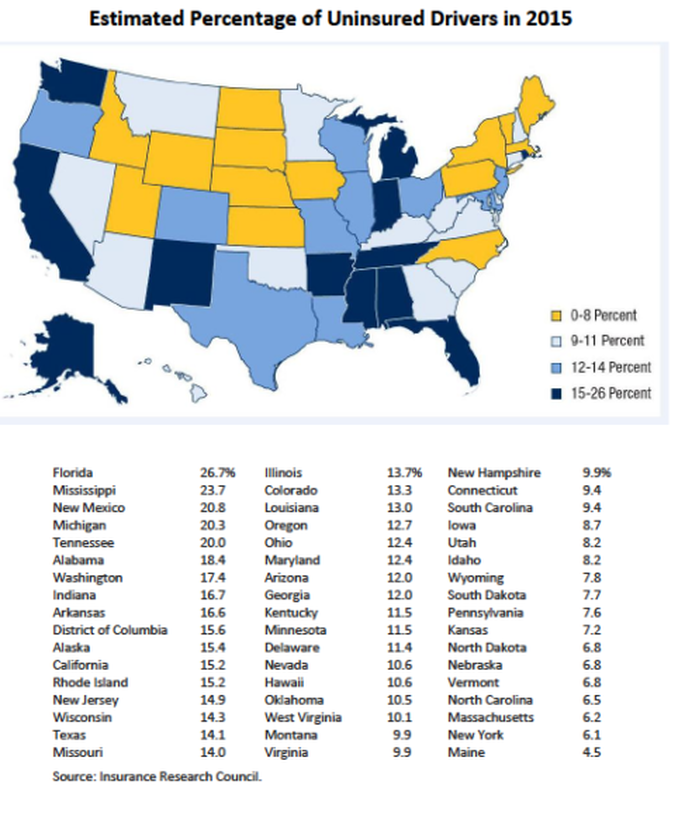

The study, directed by the Insurance Research Council (IRC) and co-sponsored by The Hanover Insurance Group, found that 13 percent of all U.S. motorists were uninsured in 2015, up from 12.3 percent in 2010, following a seven-year decline from a high of 14.9 percent in 2003. When an uninsured driver is at fault in an accident, insured drivers or their insurance companies often are left to pay for the resulting physical damage and health costs. Similarly, an underinsured driver may not have high enough policy limits to cover all costs of damage. “The results of the survey sound an alarm,” said Daniel Halsey, president, personal lines, at The Hanover. “Uninsured motorists represent a significant risk to insured drivers.” Halsey said the average cost of an uninsured motorist claim is about $20,000, excluding any physical damage to the vehicle. Despite the fact that 49 states require car insurance, some drivers choose to drive without coverage. The number of uninsured motorists varies by state, ranging from a low of 4.5 percent of all drivers in Maine to a high of 26.7 percent in Florida, according to the Insurance Research Council. Mississippi, New Mexico, Michigan and Tennessee are with Florida in the top five states based on rate of uninsured motorists, while North Carolina, Massachusetts, New York, and Maine have the lowest rates. Despite the recent increase in the countrywide rate, several states experienced significant declines. Oklahoma’s UM rate in 2015 was 10.5 percent — 15.4 percentage points lower than in 2012. New Mexico’s fell from 29.8 percent in 2006 to 20.8 percent in 2015. However, twice as many states saw their UM rate increase as decrease from 2010 to 2015. “While some states saw significant drops in their uninsured motorists rates, overall, the rate is increasing nationwide,” said Elizabeth A. Sprinkel, senior vice president, IRC. “This can mean added risk for all motorists.” The Hanover used the results to urge drivers to discuss uninsured/underinsured motorist coverage with their independent agents. Generally, it is a good idea for motorists to have the same amount of uninsured and underinsured motorist coverage as bodily injury coverage, according to the insurer. The IRC study, Uninsured Motorists, 2017 Edition, examined data collected from 14 insurers representing approximately 60 percent of the private passenger auto insurance market in 2015. Let Natwick Insurance take a look at your commercial and personal auto insurance to make sure you have the right coverage to protect your family and business. Call 321-735-0381 or visit www.natwickinsurance.com. Article Found Here: https://www.mynewmarkets.com/articles/183214/insurance-research-council-rate-uninsured-motorists-rising-nationwide

0 Comments

Federal Flood Insurance Average Premium to Rise 8%. According to The Insurance Journal, you can expect Federal Flood Insurance to go up! A typical premium charged by the National Flood Insurance Program is slated to rise about eight percent in the coming year, with the estimated average premium going from $866 to $935. When various surcharges are added, the total average amount billed a policyholder will increase to $1,062. However the premium hikes are likely insufficient to keep the program from sinking into debt, according to a recent government report. The higher premiums and other changes for new businesses and renewals began April 1, according to the Federal Emergency Management Agency (FEMA) in a bulletin summarizing NFIP program changes effective April 1, 2018. The changes bring the NFIP in line with provisions of flood insurance reform laws including the Biggert Waters Flood Insurance Reform Act of 2012 and the Homeowner Flood Insurance Affordability Act of 2014. The 2012 and 2014 flood insurance laws’ requirements behind the premium and surcharge increases include:

On March 23, the NFIP was reauthorized until July 31, 2018. The extension was included in the $1.3 trillion omnibus spending bill signed by President Donald Trump. The disasters of 2017 created one of the busiest years for the NFIP to date —by the end of last year, FEMA said the NFIP had paid out more than $8 billion in flood insurance claims during 2017. Last October, Congress passed and President Trump signed into law a hurricane and wildfire disaster relief bill that provided $16 billion in debt relief to the NFIP, which was about to run out of money to pay claims from hurricanes because it had reached the $30 billion limit on its ability to borrow form the U.S. Treasury. According to a Congressional Budget Office (CBO) report issued last fall (National Flood Insurance Program Financial Soundness and Affordability), these latest premium increases are unlikely to keep the NFIP from eventually falling into the red again. That’s because the NFIP’s current approach to setting premiums has underestimated how much its claims will cost by about $1.1 billion and legislated surcharges are about $300 million shy of covering the premium discounts given to certain properties, according to the CBO. CBO concluded that the overall NFIP shortfall is largely caused by underpricing in coastal counties, which account for three-quarters of all NFIP policies nationwide. The difference is largely due to legislated subsidies built into the NFIP and FEMA’s rate-setting system, both of which it says favor coastal policyholders. Yet despite being favored in pricing, the number of coastal homes with flood insurance has been falling, according to a report by The Associated Press. Why the decline? The report cited rising premiums and banks not enforcing the requirement that any home with a federally insured mortgage in a high-risk area have flood coverage. The House has passed several reforms of the NFIP but the Senate has not advanced any measures. Article found on Insurance Journal link to original article: https://www.insurancejournal.com/news/national/2018/04/02/485019.htm |

Contact Us

(321) 735-0381 Archives

November 2019

Categories |

Navigation |

Social MediaShare This |

Contact UsNatwick Insurance, Inc.

1301 South Patrick Drive Suite 73 Satellite Beach, FL 32937 (321) 735-0381 Click Here to Email Us |

Location |

Natwick Insurance, Inc. - Established 2006

RSS Feed

RSS Feed